1. Core Factors That Affect Price

The price of industrial rubber sheets mainly depends on:

Raw materials

Performance and certification

Dimensions and customization

Production complexity

Procurement scale

These factors all play a key role in determining costs.

Raw Material Cost (Primary Driver): Using reclaimed or recycled rubber cuts raw material costs.

Recycled sheets can lower costs by 10% to 20% compared to virgin grades, according to industry estimates.

Commodity industrial sheets on global B2B platforms usually cost between $2 and $8 per kg. This price applies to standard nitrile or EPDM sheets. In contrast, higher-grade virgin nitrile or specialty elastomers cost much more.

Performance parameters and certification affect price. Key factors include electrical insulation class, oil and chemical resistance, and certified food or medical grades. For example, market indexes and supplier price lists show that base EPDM-like rubber costs about $2.50–$3.00 per kg. In contrast, nitrile (NBR) industrial sheets usually range from $3.00 to $6.00 per kg. Specialty grades with third-party food or medical reports can be 50%–100% more expensive or even higher.

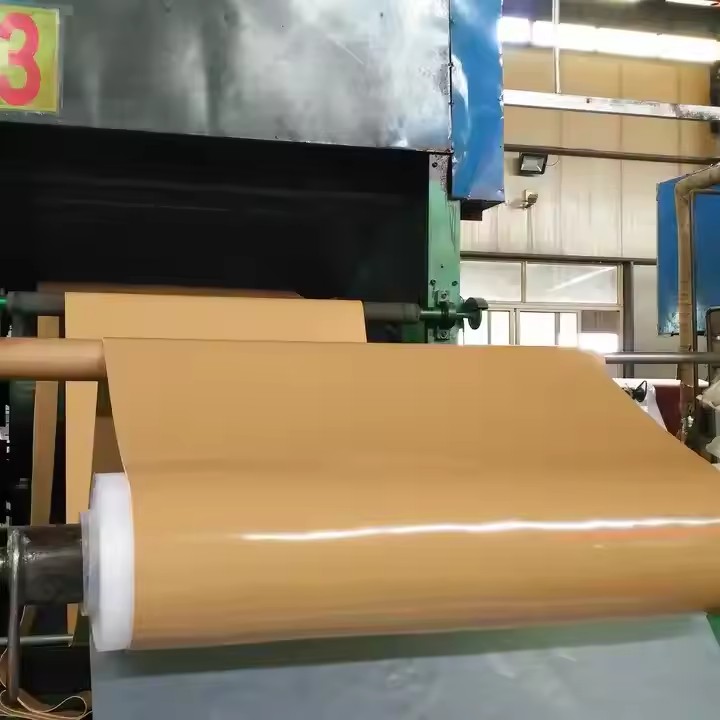

Size, Thickness, and Customization: Thickness and custom processing raise unit costs. Adding thickness or using multi-layer construction often raises the cost per kg or per piece. This increase depends on the material.

Supplier examples show thin commercial sheets or rolls priced in the low tens of USD per sheet. Heavy custom slabs or thick rolls cost more per finished piece. Custom cutting, adhesive backing, CNC profiling, and large bespoke items add about 20% to 50% to the base material cost.

Production complexity increases costs. This includes composite constructions like fabric-reinforced, multi-layer vulcanized laminates. Specialty surface treatments also add to expenses. Typical industry guidance suggests that these processes cost about 20% to 30% more than regular vulcanized sheets. Extreme custom methods, such as ceramic embedding and high-density wear tiles, raise prices even more. These are often quoted on a case-by-case basis.

Buying in bulk lowers unit costs. Many suppliers on Alibaba and similar sites offer tiered pricing. Orders of 1 metric ton or more get big discounts. Seasonality and raw material tightness are important. Market reports show that EPDM and fluoroelastomer feedstock prices can change with petrochemical cycles. This affects sheet prices.

2. Price Reference by Quality Tier (approximate, USD per kg; sourced from international supplier listings and market indexes)

| Quality tier | Typical core materials | Typical applications | Approx. price range (USD/kg) | Representative sources |

|---|---|---|---|---|

| Economic / commodity | Reclaimed rubber, SBR blends | General cushioning, nonspecialist matting | $1.5–4.0 / kg | Alibaba commodity listings, bulk offers. |

| Standard industrial | Virgin NBR (nitrile), EPDM, CR | Oil-resistant sealing, low-voltage insulation, gaskets | $3.0–12.0 / kg (depends on spec & MOQ) | Alibaba / supplier catalogues; modern rubber retailers. |

| High-performance | Silicone (industrial grade), high-temp NBR variants | High-temperature sealing, food/medical with certificates | $10–60 / kg (silicone varies widely by grade) | Industrial silicone supplier listings; rubber market guides. |

| Specialty & engineered | Fluoroelastomers (FKM/Viton), ceramic-composite, custom laminates | Aerospace, chemical processing, extreme wear/high temp | $25–200+ / kg (FKM market indexes often quoted per MT: ~$25–35/kg regionally; highly engineered composites much higher) | Fluoroelastomer price indexes, specialized suppliers. |

3. Procurement Guidance (practical, internationally oriented)

Match performance to real needs.

For oil resistance, pick virgin NBR or NBR blends. On global B2B platforms, NBR industrial sheets usually cost between $3 and $12 per kg. Prices depend on specifications and minimum order quantities (MOQ). For electrical insulation, prefer EPDM or specified insulating grades.

Optimize ordering strategy

Combine “bulk-standard parts and on-demand special parts.”

Buy common gauge sheets in bulk (≥1 ton) for 10%–30% discounts on international platforms.

Reserve specialty or custom pieces as needed.

Alibaba catalogs and supplier MOQs commonly show stepped discounts at higher volumes.

Control quality risk.

Must provide material and process certificates (ISO/ASTM/GB or third-party lab reports). For reclaimed-content products, set a maximum blend ratio (e.g., ≤30% reclaimed) and ask for a sample test. Use independent lab verification when failure modes are safety- or liability sensitive.

Hedge price volatility

Secure quarterly contracts with price adjustments, such as ±10%, based on the agreed feedstock index. Also, consider pre-buying key raw materials before peak season. Market notes state that price cycles for polymer feedstocks, such as rubber and EPDM, greatly affect sheet pricing.

4. Example Conversions & Illustrative Cases (to help buyers negotiate)

A bulk quote for commodity nitrile sheets ranges from $4,090 to $4,155 per MT. This comes to about $4.09 to $4.16 per kg. It matches the lower end of industrial nitrile pricing on key B2B platforms. Use such MT-level quotes to benchmark per-kg offers.

EPDM feedstock prices in market reports have been about $2.50–3.00 per kg recently. So, raise finished-sheet quotes to cover processing, vulcanization, and finishing costs.

Fluoroelastomer (FKM) price indexes typically show around $25–35/kg (or per MT in charts). This is why FKM products often have higher prices compared to commodity rubbers.

5. Conclusion and Engineering Recommendations

5. Conclusion and Engineering Recommendations

industrial rubber sheets price varies widely by material, certification, and custom process. Practical recommendations:

Select materials based on their function:

Use NBR for oil resistance.

Choose EPDM for weather and insulation.

Opt for silicone at high temperatures.

Pick FKM for chemical resistance.

Use a mixed sourcing strategy. Buy bulk routine gauges and order custom parts for each project. This helps control the capital tied up in inventory.

Request test reports and samples before placing large orders.

For reclaimed-content goods, ask for documented blend ratios.

Allow a 10% to 15% margin for material waste during cutting and installation. For complex terrain, use wider rolls to reduce in-field splicing.

Hongwo Sealing Sheet

Hongwo Sealing Sheet

5. Conclusion and Engineering Recommendations

5. Conclusion and Engineering Recommendations

Scan the QR Code to start a WhatsApp chat with us.